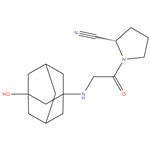

Vildagliptin 99%

| Price | Get Latest Price | ||||

| Packge | 1MT | 1kg | 5kg | 10kg | 25kg |

- Min. Order:1MT

- Time:2024-01-02

Product Details

- Product NameVildagliptin

- EINECS No.630-410-0

- MFC17H25N3O2

- MW303.4

- AppearancesolidWhite

- Melting point 153-155?C

- storage temp. Keep in dark place,Inert atmosphere,Store in freezer, under -20°C

- density 1.27

- Boiling point 531.3±50.0 °C(Predicted)

Company Profile Introduction

Sekhmet Pharmaventures

Gamot API is the holding company of Sekhmet Pharmaventures Pvt. Ltd. Asian private equity major PAG has formed an investment platform called Gamot API Pte. Ltd. based in Singapore, along with Indian private equity firms, CX Partners and Samara Capital, to buy stakes in fast-growing Indian pharma companies. The Indian subsidiary of Gamot API is known as Sekhmet Pharmaventures Pvt. Ltd.

Sekhmet Pharmaventures has acquired major stake in Chennai-based Anjan Drug Pvt. Ltd. in October 2020. Subsequently, Sekhmet Pharmaventures acquired major stake in Optimus Drugs Group of Companies in May 2022. The Company plans to invest in multiple manufacturing facilities dedicated to Active Pharmaceutical Ingredients and formulations, as India is expected to become an important part of the global supply chain, amid changing geopolitical dynamics.

PAG is one of Asia’s leading investment firms, having a world-class platform and an unparalleled network of local, experienced investment professionals. PAG manages US$45 billion in capital across strategies including private equity, real estate and absolute returns. Some of PAG’s past investments include Sinopharm, Alphamab Oncology, Cushman & Wakefield, Universal Studios, Japan, Hisun Bioray and Tencent Music Entertainment.

CX Partners is a private equity group in the Indian mid-market, with a track record of delivering returns through cycles. CX Partners has invested in diversified sectors which include companies such as Thyrocare, Natco Pharma, Sutures India, Barbeque Nation, Security & Intelligence Services and NTL Electronics.

Samara Capital is private equity firm with strong operating capabilities, focus on long term business ownership and value creation, while driving positive impact for all stakeholders. Some of the investments made by Samara Capital in the past include More retail, Sapphire foods, Monte Carlo fashions, Lotus Surgicals, AIG Hospitals, RBL Bank and Oilmax Energy.

Anjan Drug

Part of the platform since Oct 2020

Anjan Drug Private Limited was founded in 1990 by Mr. C Kalaichelvan. Anjan has grown into a fully integrated Pharmaceutical API manufacturing Organization, backed with immense experience in development and manufacturing.

Anjan is one of India’s leading manufacturers of unique Active Pharmaceutical Ingredients (API). Since its inception in 1990, Anjan Drug Private Limited has achieved the potential to deliver over a minimum of one ton measure of unique active ingredient in just 24 hours. This clearly reflects the trust our partners who in turn, are world class players in the pharmaceutical world have in our capability and quality performance. Adhering to stringent GMP guidelines, Anjan’s products hold USDMF, TGA & EuCOS approvals, clearly ensuring its supreme quality of its products.

Supplier other products

Recommended supplier

-

VIP1年

- SOLFYN INTERNATIONAL LLP

- (2S)-1-[2-[(3-hydroxy-1- adamantyl)amino]acetyl] pyrrolidine-2-carbonitrile 99%

- Inquiry

- 2024-12-03

-

VIP1年

- LOBERAN PHARMA

- (S)-1-[2-(3-Hydroxy-adamantan-1-ylamino)-acetyl]-pyrrolidine-2-carbonitrile >98.5

- Inquiry

- 2024-11-14

-

VIP1年

- Scimplify

- 274901-16-5 Vildagliptin -HIS 99%

- Inquiry

- 2024-10-25

-

VIP1年

- SETV ASRV LLP

- 274901-16-5 95-99%

- Inquiry

- 2024-09-11

-

VIP1年

- ADAARSH PHARMA

- Vildagliptin -HIS 274901-16-5 99%

- Inquiry

- 2024-05-03

-

VIP1年

- Gokulendu Life Science

- Vildagliptin 99%

- Inquiry

- 2024-03-21

-

VIP1年

- Symed Laboratories Ltd

- 274901-16-5 Vildagliptin 98%

- Inquiry

- 2024-03-21

-

VIP1年

- STANDHARDT INNOVATIONS PVT LTD

- Vildagliptin 98%

- Inquiry

- 2024-03-21

-

VIP1年

- Actis Generics Pvt Ltd

- Vildagliptin 98%

- Inquiry

- 2024-03-20

-

VIP1年

- Medec Dragon Private Limited

- 274901-16-5 99%

- Inquiry

- 2024-03-19

- Since:2020-01-01

- Address: 404, Windfall, Sahar Plaza Complex, J. B. Nagar, Andheri-Kurla Road, Andheri-E, Mumbai, India